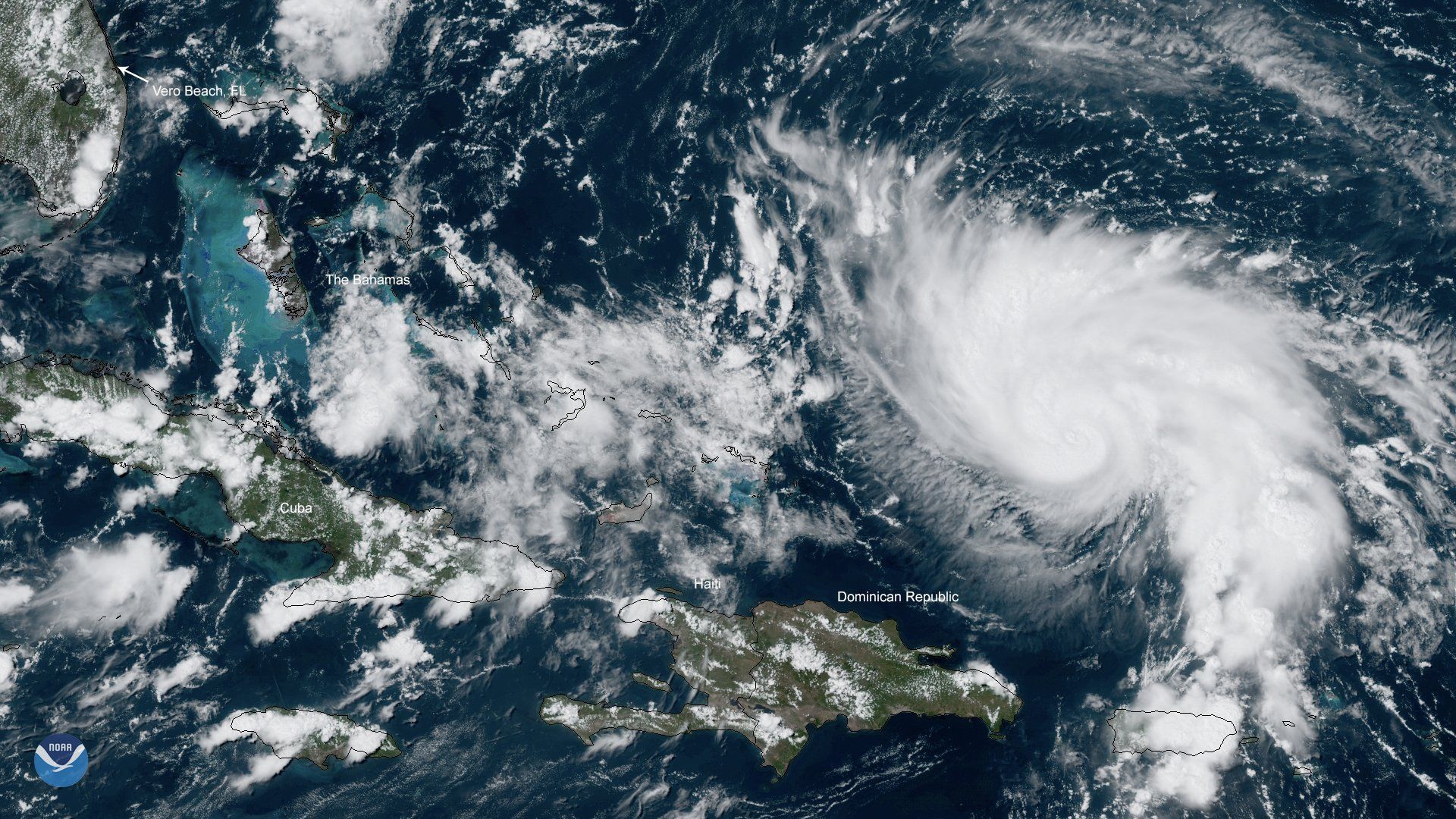

How to protect your business from a Hurricane.

Rachael Eslao • March 31, 2021

Hurricane Season is coming... protect your business before it's too late.

Businesses can suffer significant losses due to wind and hail storms, which can result in costly repairs and extended business disruptions. In addition to the typical structural damage caused by a storm, gale force winds can push trees or projectiles into your building, and hail can shatter your windows and take damage to your exterior.

In addition to your small business insurance being in place, take these steps to lessen the risk of damage to your company from a storm.

Keep your roof in good shape.

In the event of a hurricane, the roof cover is one of the most vulnerable parts of a building. Routine maintenance can prevent roof damage and prolong the life of your roof cover.

- Check your roof cover several times throughout the year, especially around season change and after storms.

- Be aware of bubbles, cracks, and ponding water.

- Clean up excess debris and make sure materials are not loose or missing from time to time.

- Invest in a preventative maintenance plan by hiring a licensed roof contractor.

Make sure equipment and valuables are secure

Watch the weather forecast if you live in an area vulnerable to strong winds or hail so you can secure your belongings before the storm hits. Any items of high value should be locked or secured away from windows and stored up high. Outdoor equipment should also be secured to ensure that it doesn't get blown away during a storm.

Make sure your business is adequately insured against wind and hail.

Insurance companies offer commercial property insurance, which can cover the costs of repairing or replacing damaged property, such as equipment, supplies, and structures after a storm. BOP, or business owner's policies, are designed especially for small businesses, cover properties and liabilities at an affordable price. They are also capable of paying damages to business property in the event of a storm.

A higher premium is possible for insurance coverage within high-risk zones. This could be beneficial if you have a serious storm.

Roof Tarp & Board Up restoration team is on standby in case your home or business suffers damage from a storm or other disaster. Getting started is as simple as contacting them today.